New Medium-term Management Plan

May 12, 2020

Resona Holdings, Inc.

Resona Holdings, Inc. ("Resona") hereby announces that today it has formulated a new Medium-term Management Plan that aims to establish "Resonance Model" and covers the three-year period beginning from fiscal year 2020.

In Japan, irreversible changes in the social structure are accelerating. These include demographic decline and graying, rapid digitalization, and the continued diversification of customer behavior. Moreover, in addition to the prolongation of a negative interest rate policy, the novel coronavirus pandemic, which has severely affected the global economy, is also having a major impact on economic trends in Japan. Currently, domestic economic activities, including consumption and production, have largely fallen into stagnation due to travel and social restrictions.

The environmental changes described above are expected to extend over the medium and long terms, with businesses facing a growing need to ensure their responsiveness in the face of unexpected situations. Given this, the Resona Group (the "Group") has designated "contributing to the creation of a sustainable society while achieving sustainable corporate growth" as its medium- to long-term vision. Starting from this vision, the Group has taken a backcasting approach to formulate the new medium-term management plan.

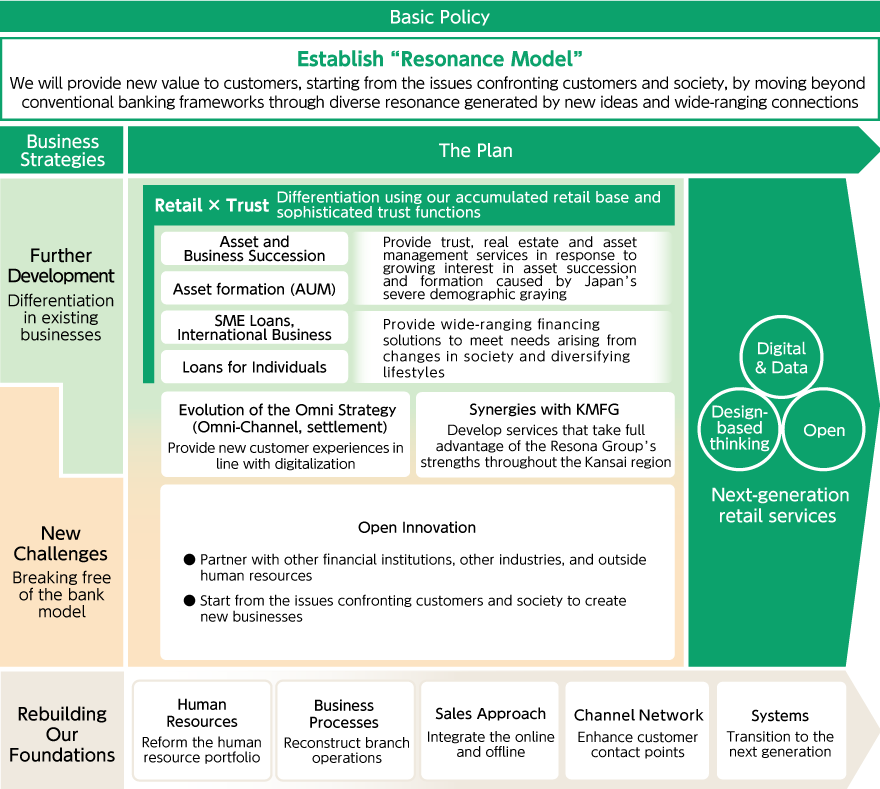

In the new Medium-term Management Plan (the "Plan"), we have positioned establishing "Resonance Model" as our basic policy. This means starting from the issues confronting customers and society, we will provide new value to customers through diverse resonance generated by moving beyond conventional banking frameworks.

Under the Plan, we will continue to focus the collective efforts of the Group on becoming the "Retail No. 1" while remaining true to our basic stance that "Customers' happiness is our pleasure."

I. Vision

"Retail No.1"

A "services group" that is most supported by regional customers as it walks together with them into the future

II. Basic Stance

Customers' happiness is our pleasure

III. Plan Period

FY2020 to FY2022 (FY ending March 31, 2021 to FY ending March 31, 2023)

IV. Key Points of the Plan

- We have designated as our medium- to long-term vision (for 2030) "contributing to the creation of a sustainable society" by adapting to changes in the environment and social structures while simultaneously "achieving sustainable growth" for the Group through resonance with customers and society

- To achieve this vision, we have designated as our basic policy establishing "Resonance Model" that provides new value to customers through diverse resonance generated by new ideas and wide-ranging connections

V. Overview of the Plan

VI. Basic Policy

Establishing "Resonance model" means we will adapt to changing times and provide new value to customers, starting from the issues confronting customers and society, by moving beyond conventional banking frameworks through diverse resonance generated by new ideas and wide-ranging connections. By positioning the resonance model as a central axis of thinking and action for every employee, we will achieve the aims of the Plan.

1. Starting from the Issues Faced by Customers and Society

- Reexamine all the Group's business activities with a focus on addressing both the many-layered issues our customers are confronting and social issues.

- In addition to focusing on "what is troubling the customer," pay close attention to "why" in a continuous effort to examine how to solve such issues.

- Reexamine our customer relationships with an eye to changing the dynamic from a series of points of intersection to a continuous line based on lifestyles, life cycles, life events, and everyday changes in circumstances and thereby provide diverse services that go beyond finance.

2. Diverse resonance generated by new ideas and wide-ranging connections

- In light of accelerating digitalization and other changes in social structures, we will merge our conventional business model with three drivers* to adapt it and our management foundations to the changing times.

- Aware that the pace of change is now faster than previously anticipated, we will look for mechanisms, organizations, human resources, and methods that will enable us to implement strategy and concrete measures faster than ever before.

- *Three drivers

Building on the solid customer relationships the Group has established over the years under its focus on retail financial services, we will innovate our business model and management foundations using the drivers "Digital & Data," "Design-based Thinking," and "Open."

| Digital & Data |

|

|---|---|

| Design-based Thinking |

|

| Open |

|

VII. Business Strategies

We will work to thoroughly differentiate our traditional indirect financing operations (trust and commercial banking) through further development. At the same time, we will take on new challenges by pursing new businesses based on innovative ideas to break free of the bank model. By doing so, over the medium to long term, we will evolve into a group that offers next-generation retail services and reform our earnings structure.

1. Further Development

- We will upgrade our succession business, which takes full advantage of the Resona Group's retail sales capabilities and base, sophisticated trust services. At the same time, we will focus efforts on further evolving the Omni Strategy that we pushed forward under the previous medium-term management plan.

- Throughout the Kansai region, where the Kansai Mirai Financial Group ("KMFG") maintains its operating base, we will develop services and functions supported by Resona's distinctive strengths in pursuit of synergy with the entire Resona Group.

| Asset and Business Succession |

|

|---|---|

| Asset Formation (AUM) |

|

| SME Loans, International Business, Loans for Individuals |

|

| Omni-Channel, Settlement |

|

2. New Challenges (Open Innovation)

- Through new ideas and wide-ranging connections, we aim to provide new value to customers and society while expanding the scope of the Resona Group's business and diversifying opportunities for earning profit.

- Starting from the issues customers and society are now confronting, we will leverage partnerships with other financial institutions, other industries, outside human resources and communities. We will also employ our corporate frameworks, which enable us to maintain a position as an "advanced banking service company" as defined under the Banking Act, as well as dedicated cross-functional teams that span multiple organizational units. In these ways, we will create new businesses in which we can effectively exercise the Resona Group's advantages.

VIII. Rebuilding Our Foundations

To successfully further develop and take on new challenges in our businesses, we must deconstruct the high-cost structure of our retail businesses and effectively allocate management resources. Focusing on the three drivers, we will rebuild our business model and management foundations as we work to reinforce our sales capabilities and raise productivity.

| Human Resources |

|

|---|---|

| Business Processes |

|

| Sales Approach |

|

| Channel Network |

|

| Systems |

|

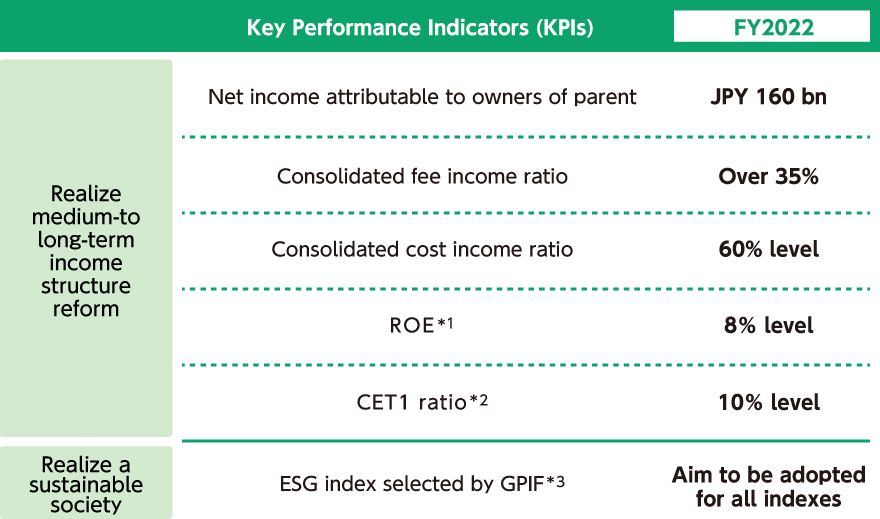

IX. Capital Management Policy

Resona will pursue an optimal balance between financial soundness, profitability and shareholder returns and endeavor to enhance corporate value.

1. Financial Soundness

With regard to the target capital adequacy ratio in the final year of the Plan, while prioritizing the three items described below, we will secure sufficient equity capital under the current Japanese standard and aim for a common equity tier 1 ratio (excluding net unrealized gains on available-for-sale securities; based on regulations to be effective upon the enforcement of the finalized Basel 3) of approximately 10% under the international standard.

- (1)Further contributing to the development of regional communities and economies through the steady supply of funds and the provision of services, etc.

- (2)Securing capital as a trusted financial institution from a global perspective and realizing sustainable growth

- (3)Securing strategic flexibility to respond to investment opportunities and financial regulations

2. Profitability

We will continuously engage in financial management conscious of capital efficiency, risk, cost and return, and aim to secure ROE exceeding 8%.

3. Shareholder returns

- We will maintain a stable dividend stream and work to enhance shareholder returns while considering such factors as the balance between financial soundness and profitability and opportunities for growth investments.

- Specifically, we will aim for a total shareholder return ratio of middle 40% range in the medium term.

X. Key Performance Indicators

Key performance indicator targets for the final year of the Plan are as shown below.

[FY2022 assumed conditions : Overnight call rate (0.05) %, Yield on 10Y JGB (0.05) %, Nikkei 225 23,000 yen]

- *1Net income / Total shareholders equity (simple sum of the balance at the beginning and the end of the term)

- *2Based on the finalization of Basel 3. Exclude unrealized gain on available-for-sale securities

- *3FTSE Blossom Japan Index, MSCI Japan ESG Select Leaders Index, MSCI Japan Empowering Women Index(WIN), S&P/JPX Carbom Efficient Index Series