Resona Group at a Glance

Resona Group is a financial services group which has a holding company, Resona Holdings, with Resona Bank, a largest commercial bank with a full-line trust capabilities in Japan, Saitama Resona Bank, which has overwhelming market shares in Saitama Prefecture, Kansai Mirai Bank, which has a strong presence as a regional bank in the Kansai region, and Minato Bank, which has a branch network No.1 Hyogo Prefecture. Total assets are approximately 77 trillion yen, the 4th largest after the 3 megabanks.

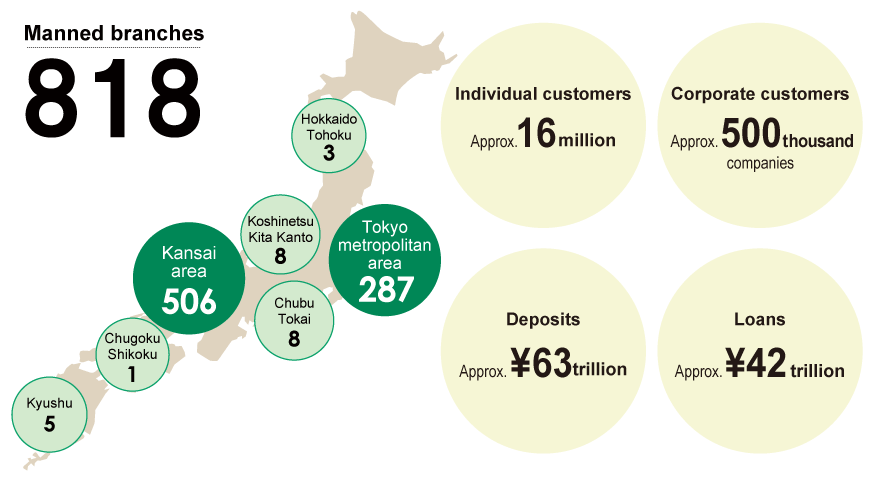

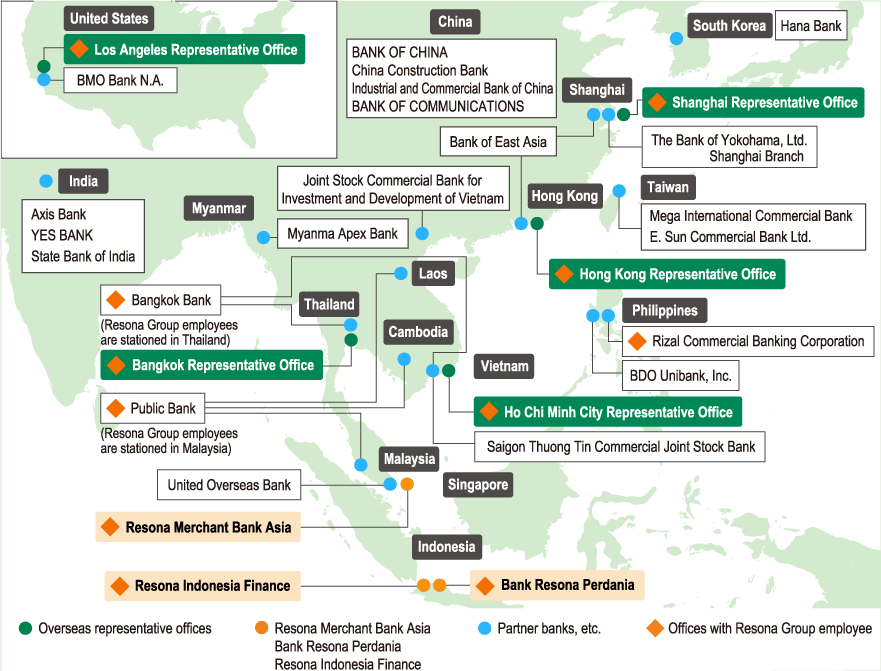

Resona Group Network

Japan

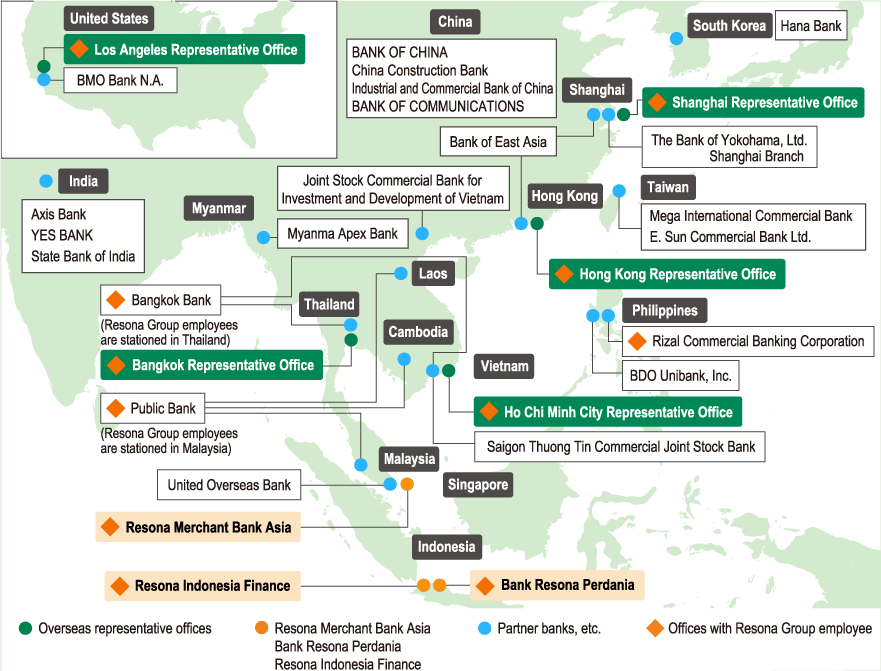

Overseas

Resona’s Position

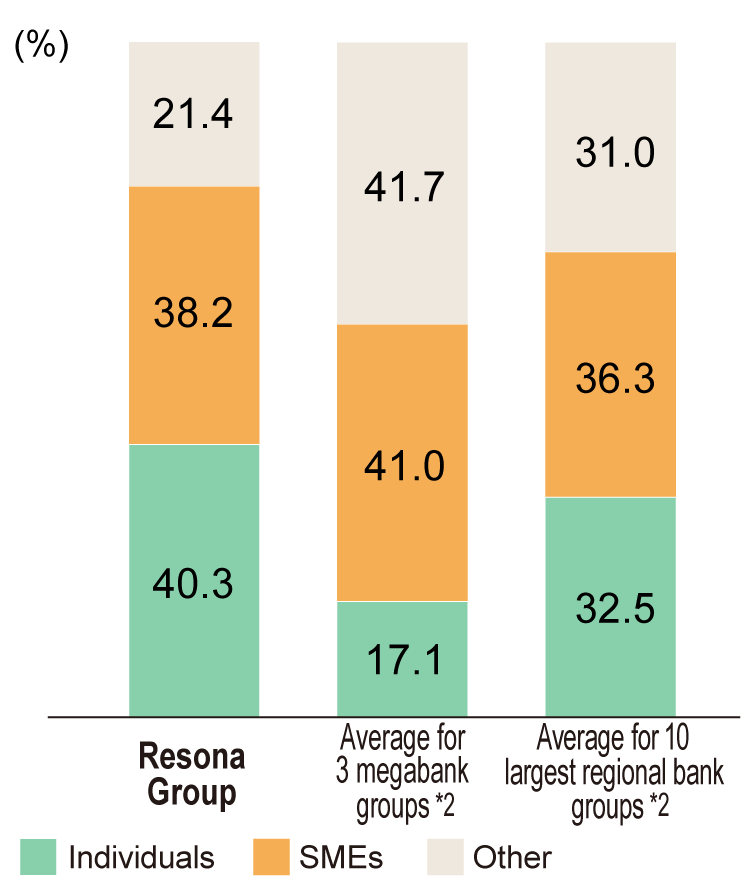

Loan portfolio*1

The Resona Group focuses on retail loans. Loans to individuals and SMEs account for about 80% of its loan portfolio.

(As of March 31, 2025)

- *1Total of group banks, Source : Financial statements from each company

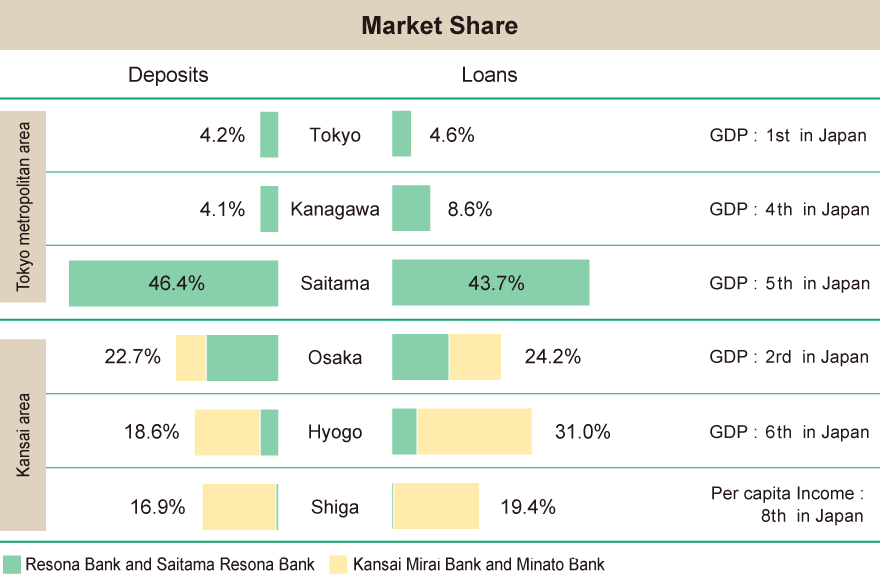

Loan and deposit market share*2

The Resona Group has a strong customer base in the Tokyo metropolitan area and the Kansai area, where economic activity and population are concentrated. Loan and deposit market share is particularly strong in Saitama Prefecture, where it exceeds 40%, and we also have a large presence in Osaka, Hyogo, and Shiga Prefectures.

(As of March 31, 2025)

- *2Total of Group banks. Market share based on deposits, loans and bills discounted by prefecture (domestic banks licensed by BOJ).