Risk Management

Risk Management System

Basic Approach to Risk Management

We deeply regret the serious concern and inconvenience that the application for an injection of public funds in May 2003 caused the people of Japan, our customers, and other stakeholders. Consequently, we have established the three risk management principles shown below to enhance our risk management systems and methods as well as risk control. The Resona Group conducts its risk management activities with an eye to securing the soundness of operations and enhancing profitability.

Three Risk Management Principles

- 1.We will not assume levels of risk in excess of our economic capital.

- 2.We will deal promptly with losses that we have incurred or expect to incur.

- 3.We will take risks appropriate for our earnings power.

Risk Management Policies and Systems

The Resona Group is exposed to various types of risk, including those associated with business strategies, the violation of laws and regulations and systems failures as well as those related to business outsourcing (e.g., suspensions of operations and information leaks involving vendors).

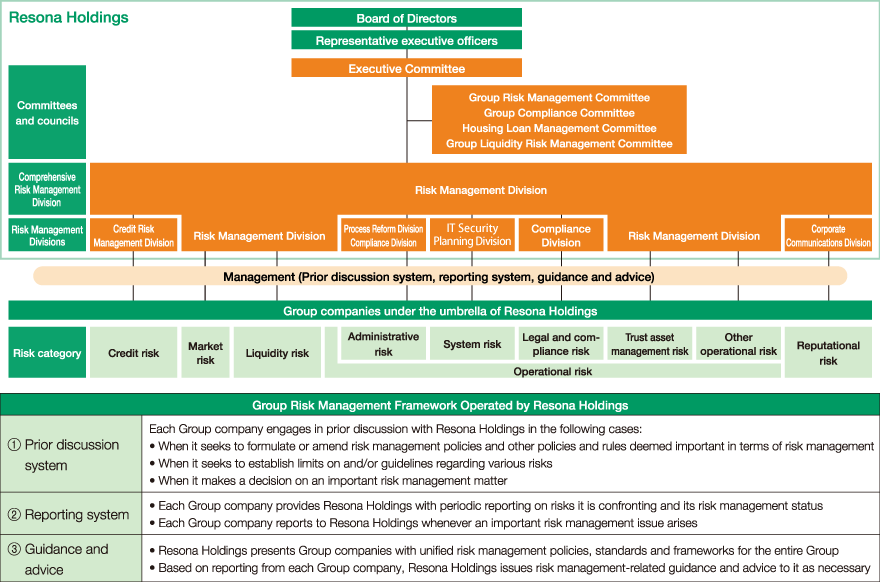

As it aims to appropriately handle these risks in adherence to the three risk management principles, Resona Holdings has established the Group Risk Management Policy. This policy is intended to clarify types and definitions of risks to be managed and the organizational structure for risk management as well as the fundamental risk management framework, with the aim of developing a robust risk management system for the Group.

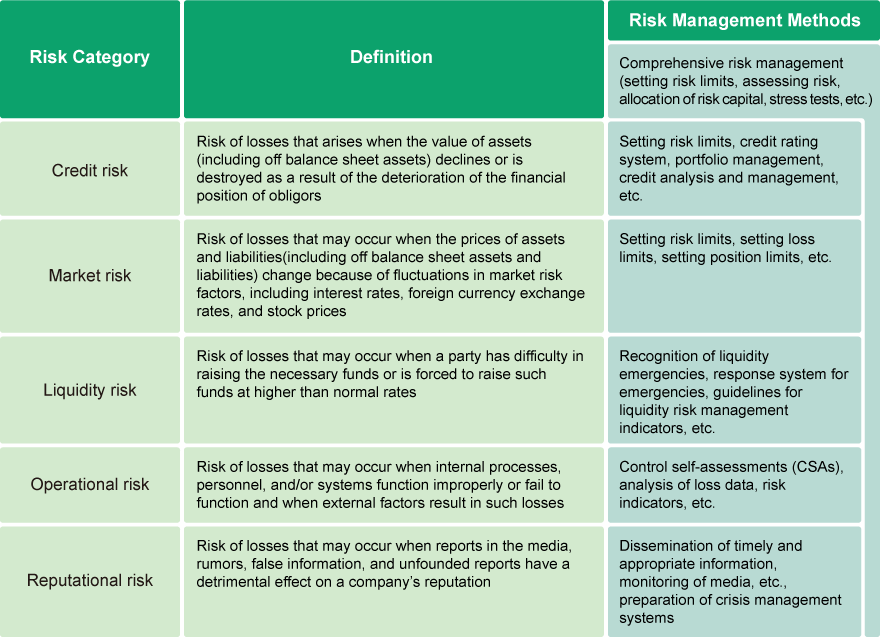

Specifically, the policy classifies risks as shown in the table below, and stipulates that risk management divisions specializing in each risk category must be in place in addition to divisions tasked with comprehensively managing enterprise risks (comprehensive risk management divisions), ensuring that optimal risk management methods are used by these divisions in light of risk characteristics.

As stipulated by the Group Risk Management Policy, Resona Bank, Saitama Resona Bank, Kansai Mirai Bank and Minato Bank (the “Group banks”) have established risk management policies that are tailored to their operations, unique characteristics and the risks they must address while maintaining risk management divisions handling risks in each risk category as well as comprehensive risk management divisions.

Principal Group companies, other than the banks, have also established risk management policies that are tailored to their own operations, special characteristics and risks.

These policies establish guidelines for avoiding risks outside their fundamental business areas. These Group companies have also established risk management departments for managing different categories of risk and risk management divisions for comprehensive risk management.

Primary Risk Category, Definition and Management Methods

Group Management by Resona Holdings

Qualitative Risk Management

The Company provides Group banks and other Group companies(hereinafter collectively "Group companies") with direction and suggestions regarding risk management policies, standards, and systems that must be shared by all Group members. When making decisions on important matters related to risk management, Group companies confer with the Company in advance and base their decisions on those consultations or decide matters through the exchange of opinions, and report those decisions to the Company as necessary.

Based on the framework described above, the Company maintains a firm grip on risk management policies, standards and systems in place at each Group company, thereby ensuring qualitative risk management for the Group.

Quantitative Risk Management

The Company and the Group banks have in place comprehensive risk management systems as described later, with the aim of quantitatively assessing risks and controlling them within the tolerable limits.

Furthermore, the Company maintains the quantitative management of risks each Group company is handling through prior consultation on limits and guidelines or through the exchange of opinions.

Group companies must report to the Company regarding the risk conditions and their management on a regular and as-needed basis so that the holding company can provide guidance and advice as necessary.

As shown by the figure below, we have formed risk management divisions by risk category within the Company for managing each type of risk on a Group-wide basis.

Group Risk Management System