Dividend Information

Dividend Policy

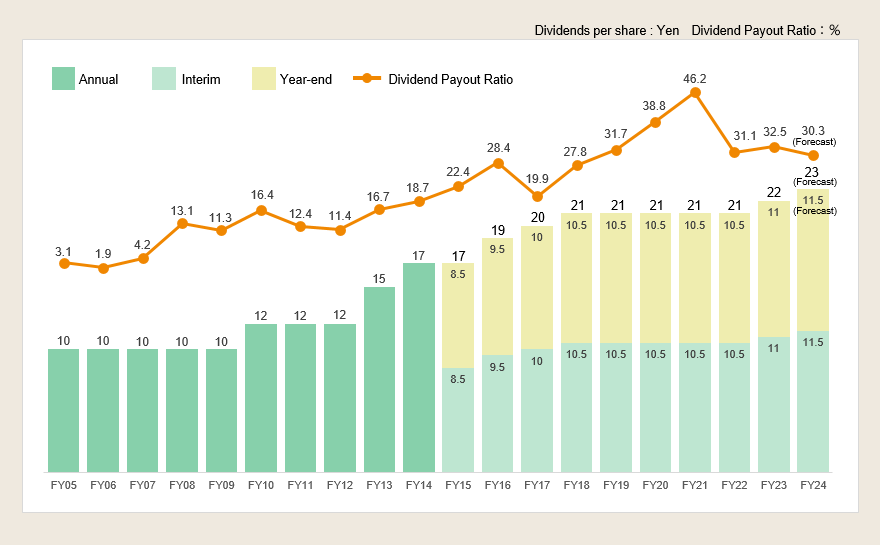

With regard to shareholder returns, while the Company will aim for a total return ratio of around 50%, Resona has set the DOE (dividend on equity) target for fiscal 2029 at around 3%, and aims to increase dividends in a stable.

Based on this policy,in FY2025, we plan to increase the dividend by JPY 4 to an annual dividend of JPY 29 per share (interim dividend of JPY 14.5 and year-end dividend of JPY 14.5).

Dividends per Share / Dividend Payout Ratio

| Annual (Yen) |

Interim (Yen) |

Year-end (Yen) |

Dividend Payout Ratio | |

|---|---|---|---|---|

| FY2025 | 29 |

14.5 |

14.5 |

26.4% |

| FY2024 | 25 |

11.5 |

13.5 |

27.1% |

| FY2023 | 22 |

11 |

11 |

32.5% |

| FY2022 | 21 |

10.5 |

10.5 |

31.1% |

| FY2021 | 21 |

10.5 |

10.5 |

46.2% |

| FY2020 | 21 |

10.5 |

10.5 |

38.8% |

| FY2019 | 21 |

10.5 |

10.5 |

31.7% |

| FY2018 | 21 |

10.5 |

10.5 |

27.8% |

| FY2017 | 20 |

10 |

10 |

19.9% |

| FY2016 | 19 |

9.5 |

9.5 |

28.4% |

| FY2015 | 17 |

8.5 |

8.5 |

22.4% |

| FY2014 | 17 |

- |

17 |

18.7% |

| FY2013 | 15 |

- |

15 |

16.7% |

| FY2012 | 12 |

- |

12 |

11.4% |

| FY2011 | 12 |

- |

12 |

12.4% |

| FY2010 | 12 |

- |

12 |

16.4% |

| FY2009 | 10 |

- |

10 |

11.3% |

| FY2008 | 10 |

- |

10 |

13.1% |

| FY2007 | 10 |

- |

10 |

4.2% |

| FY2006 | 10 |

- |

10 |

1.9% |

| FY2005 | 10 |

- |

10 |

3.1% |