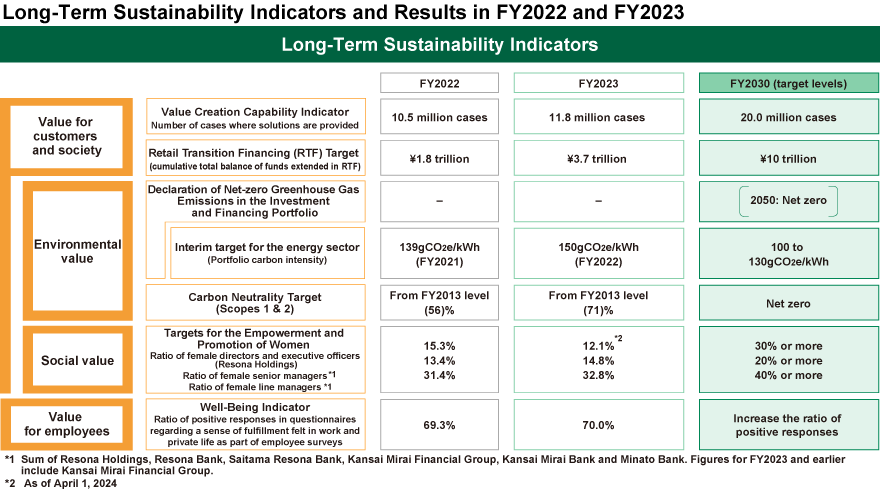

Long-Term Sustainability Indicators

To realize its Purpose of "Beyond Finance, For a Brighter Future," the Resona Group aims to create a sustainable, virtuous cycle offering new value creation to adapt to the changing times together with our customers and well-being to our employees who are the driving force behind this. In May 2023, we published our Long-Term Sustainability Indicators, which systematically organize the value we should provide into value for customers and society as well as value for employees. We aim to be a corporate group that contributes to improving various values for multiple stakeholders by solving our customers' challenges and social issues.

Value for customers and society (All)

| FY2023 | FY2024 | FY2030 Target Level | |

|---|---|---|---|

| Value Creation Capability Indicator Number of cases where solutions are provided |

11.8 million cases | 12.9 million cases | 20.0 million cases |

| Retail Transition Financing (RTF) Target (cumulative total balance of funds extended in RTF) |

JPY 3.7 trillion | JPY 5.7 trillion | JPY 10 trillion |

Value for customers and society (Environmental value)

| FY2023 | FY2024 | FY2030 Target Level | |

|---|---|---|---|

| Declaration of Net-zero Greenhouse Gas Emissions in the Investment and Financing Portfolio | - | - | 2050 Net zero |

| Interim target for the energy sector (Portfolio carbon intensity) |

150 gCO2e/kWh (FY2022) |

145 gCO2e/kWh (FY2023) |

100 to 130 gCO2e/kWh |

| Carbon Neutrality Target (Scope1+2) |

69% reduction from FY2013 |

76% reduction from FY2013 |

Net Zero |

Value for customers and society (Social value)/ Targets for the Empowerment and Promotion of Women

| FY2023 | FY2024 | FY2030 Target Level | |

|---|---|---|---|

| Ratio of directors and executive officers*1 | 12.1%*3 | 11.7%*4 | 30% or more |

| Ratio of senior managers*2 | 14.8% | 16.5% | 20% or more |

| Ratio of line managers*2 | 32.8% | 34.4% | 40% or more |

- *1Resona Holdings

- *2Sum of Resona Holdings and the four Group banks; figures for FY2023 include Kansai Mirai Financial Group

- *3As of April 1, 2024

- *4As of April 1, 2025

Value for employees

| FY2023 | FY2024 | FY2030 Target Level | |

|---|---|---|---|

| Well-Being Indicator Ratio of positive responses in questionnaires regarding a sense of fulfillment felt in work and private life as part of employee surveys |

70.0% | 72.1% | Increase the ratio of positive responses |

Long-Term Sustainability Indicators

| Value Creation Capability Indicator | Indicator that quantitatively represents the extent to which various solutions are being created and provided to the increasingly diverse and sophisticated problems faced by customers and social issues (established in May 2023) |

|---|---|

| Retail Transition Financing (RTF) Target | Financing transaction volume target that will contribute to the transition in awareness and behavior of retail customers regarding the promotion of SX (including financing in the environment-related fields) (established in June 2021) |

| Carbon Neutrality Target (Scope1+2) |

Target to reduce CO2 emissions (Scope1+2) attributable to energy used by the Group to net zero by the end of FY2030 (established in June 2021) |

| Declaration of Net-zero Greenhouse Gas Emissions in the Investment and Financing Interim target for the energy sector |

Declaration of our intention to reduce greenhouse gas (GHG) emissions from our investment and financing portfolio to net zero by 2050 and carbon intensity target for the power sector for FY2030 set as a milestone towards achieving this intention (established in May 2023) |

| Targets for the Empowerment and Promotion of Women |

Target ratio of women in executive, senior management, and line management positions that was set to expand opportunities for women’s empowerment and promotion, aiming to create new value through diversity (established in June 2021) |

| Well-Being Indicator |

Indicator that represents the percentage of positive responses to the employee survey on work-life satisfaction aimed at a sense of fulfillment in both work and private lives for our Group employees (established in May 2023) |

Please see below for detailed performance and progress of key indicators.

- Retail Transition Financing Target

- Declaration of Net-zero Greenhouse Gas Emissions in the Investment and Financing Portfolio

- Interim target for the energy sector

- Carbon Neutrality Target (Scope1+2)

- Targets for the Empowerment and Promotion of Women

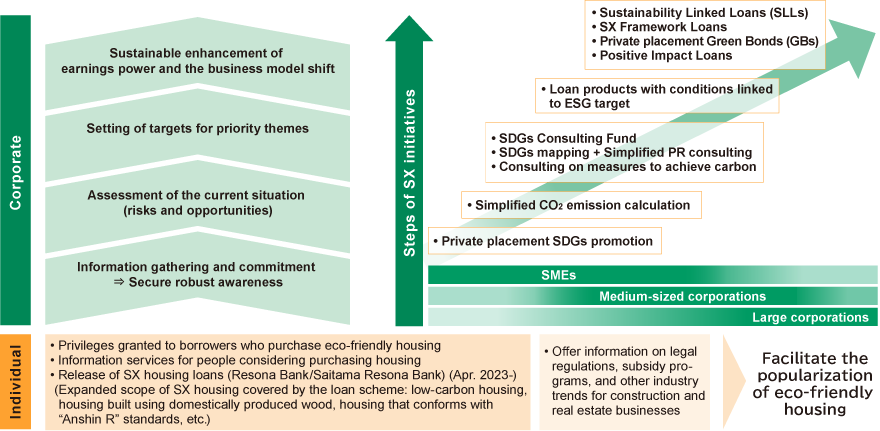

Retail Transition Financing Target

- Cumulative total of transition financing from FY2021 to FY2030: 10 trillion yen

-

Financing Coverage

Financing aimed at helping retail customers update their awareness, transform their modes of behavior and stably move forward from their current situation. (Including financing for such green projects as renewable energy generation, as well as large corporate financing involving third-party verification)

FY2024 results: Approximately 1.9 trillion yen (Cumulative total since FY2021: 5.7 trillion yen)*5

- *5Performance of each bank in the Group: Resona Bank approx. 1.29 trillion yen, Saitama Resona Bank approx. 340 billion yen, Kansai Mirai Bank approx. 200 billion yen, Minato Bank approx. 60 billion yen (of which, financing in the environment-related fields: Resona Bank approx. 250 billion yen, Saitama Resona Bank approx. 160 billion yen, Kansai Mirai Bank approx. 70 billion yen, Minato Bank approx. 30 billion yen) Investment trusts and investment advisory services run by Resona Asset Management.

| Breakdown of Financing |

Investment and financing aimed at supporting or facilitating initiatives to promote social or business sustainability Investment and financing requiring recipients to use such funds for the resolution of social issues (Main examples)

|

|---|---|

| Financing in the environment- related fields |

Investment and financing aimed at supporting or facilitating initiatives to address environmental issues (Main examples)

|

- *6Investment trusts and investment advisory services run by Resona Asset Management.

Review of FY2024 Accomplishments and Future Initiatives

In FY2024, the amount of funds extended in retail transition financing was approximately 1.9 trillion yen, virtually unchanged from the previous fiscal year, bringing the cumulative four-year total to roughly 5.7 trillion yen. This represented a progress ratio of 57% against our target of 10 trillion yen.

The breakdown of such financing has not changed substantially. The volume of financing in the environment-related and other fields was on par with the level recorded in the previous fiscal year, while the proportion of such financing in conformity with external sustainability standards remains flat year on year. In the environment-related field, funds extended as financing in conformity with external sustainability standards*7, such as the Green Loan Principles, accounted for more than 90%.

With regard to the provision of non-financing solutions, we have focused on engaging with SME customers to assess the status of their initiatives to achieve carbon neutrality via interviews. These efforts, in turn, encouraged customers to utilize our simplified CO2 emission calculation service, with the number of cases in which this service was delivered growing approximately threefold.

On the other hand, the number of SMEs that regularly assess the volume of their CO2 emissions remains low. It was also confirmed that the status of their initiatives varies greatly, depending on the size of their operations.

We will continue to facilitate in-depth dialogue with customers while strengthening our ability to deliver solutions.

- *7Financing in conformity with Green Loan Principles, Social Loan Principles and other standards

Declaration of Net-zero Greenhouse Gas Emissions in the Investment and Financing Portfolio

- Aiming for Net-zero Emissions in Terms of GHG Emissions from the Investment and Financing Portfolio by 2050

Calculation of GHG Emissions from the Investment and Financing Portfolio

Financed Emissions represent indirect GHG emissions associated with investment and financing undertaken by financial institutions and account for the largest proportion of emissions attributable to such institutions’ activities.

In order to promote the measurement, monitoring and reduction of financed emissions, the Group calculates portfolio related GHG emissions volumes in accordance with standards formulated by the PCAF*8, an international initiative, prioritizing carbon-related sectors specified by the TCFD. As the above calculation is performed using a simplified method based mostly on estimated values provided by the PCAF database, the Group recognizes the possibility of deviation from the actual volume of GHG emissions.

In addition, loans to SME customers account for the majority of the Group’s loan balance. Looking ahead, we will promote in-depth dialogue with customers and step up our supportive efforts to act as their “running partner,” with the aim of facilitating the widespread practice of emissions-related disclosure among business corporations while helping them adopt more sophisticated methods for the calculation of emissions volumes.

- *8Partnership for Carbon Accounting Financials

Financed Emissions Calculated Based on the PCAF Standards

| Sector | Credit amounts (billions of yen) |

Portfolio-related GHG emissions volume (Mt-CO2e) 〈Scope1+2〉 |

Portfolio-related GHG emissions volume (Mt-CO2e) 〈Scope3〉 |

Measurement coverage ratio (%) |

|---|---|---|---|---|

| Energy / Utility | 5,719 | 4.3 | 6.2 | 90.4 |

| Transportation / Automotive | 14,618 | 4.5 | 23.1 | 99.5 |

| Real estate development / Construction | 72,786 | 1.4 | 25.5 | 98.2 |

| Material | 6,444 | 6.1 | 11.4 | 96.3 |

| Agriculture / Food | 3,716 | 1.2 | 4.4 | 99.7 |

| Pulp / Forestry products | 1,438 | 0.7 | 1.6 | 100.0 |

| Total | 104,721 | 18.2 | 72.3 | 97.9 |

Results of the PCAF-Based Calculation of Financed Emissions

| Target assets |

|

|---|---|

| Target sectors |

|

| Target years |

|

| Formula |

|

Interim Target for the Energy Sector

- Carbon emission intensity in FY2030: 100 to 130gCO2e/kWh

Financed Emissions Associated with the Energy Sector (as of March 31, 2024)

As of March 31, 2024, the carbon emission intensity of the energy sector amounted to 145 gCO2e/kWh, an increase of (5)gCO2e/kWh year on year, yet remained below the level*9 specified under the 1.5 °C scenario (NZE2050) for 2030.

The factors leading to this decrease included the lower emission intensity reported by a portion of clients engaged in the power business due to the resumption of nuclear power plants.

While the overall amount of investment and financing grew approximately 10% year on year, funds extended in lending to clients who specialize in emission-free renewable energy power generation continued to account for about half of this amount.

- *9Comparison with the estimated carbon emission intensity of 165 gCO2e/kWh for 2030 under the NZE2050 (WEO2022).

| Scope subject to GHG emission calculation | Indicator | Results (Mar. 31, 2024) |

Amount of investment and financing | Coverage ratio | Data quality score | |

|---|---|---|---|---|---|---|

| Energy (electric power) |

Power generation Scope1 |

Physical carbon emission intensity | 145 gCO2e/kWh |

347 billion yen | 91% | 2.2 |

| Oil / Gas | Mining Scopes1 to 3 | Absolute volume | 0.12 MtCO2e |

5.6 billion yen | 100% | 2.8 |

| Coal | Mining Scopes1 to 3 | Absolute volume | - | (Not applicable) | - | - |

Support Policies for the Energy Sector

The energy sector is an infrastructure component supporting all industries as well as people’s daily lives. Accordingly, pursuing the decarbonization of this sector is essential to facilitating decarbonization among our retail customers. As the characteristics of power generation businesses differgreatly by region, decarbonization efforts must give due consideration to country and region-specific factors. Looking at factors specific to Japan, the country’s energy base is highly dependent on coal- and gas-fired thermal power generation. Moreover, there is a lack of land suited for establishing transmission networks and renewable energy power plants.

The majority of the Group’s portfolio of financing for the energy sector is accounted for by financing for domestic businesses and projects. Therefore, we will give due consideration to domestic circumstances to support the stable supply of energy even as we contribute to the widespread use of renewable energy an essential solution for decarbonization while helping clients achieve transition and technological innovation. In these ways, we will continue playing our part in the decarbonization of Japan’s energy sector.

Dialogue and Engagement with Major Domestic Power Companies

We launched discussions with major domestic power companies engaged in loan transactions with us, with the aim of promoting decarbonization.

Main points discussed thus far

- Policies and targets for decarbonization

- The content of plans for the achievement of targets

- Status of progress in the plans and issues

Through these discussions, we learned that the current energy mix varies greatly by power company and as does their potential for renewable energy generation. We also identified a variety of issues that should be tackled to realize decarbonization even as power companies strive to maintain stable supplies of the energy needed to support the industrial and living infrastructures of regional communities.

We will maintain an accurate understanding of these issues in order to continuously extend optimal financial support to facilitate transition.

Our Stance on Lending to Coal-Fired Thermal Power Generators

The Group has established and announced its “Basic Stance on Lending,” which includes a policy of abstaining from freshly extending financing for coal-fired thermal power generation, except when it finds compelling reasons to do so, such as to realize economic restoration following a disaster. The Group also plans to reduce the balance of credits extended in connection with financing for existing coal-fired power generation projects to zero by the end of FY2035.

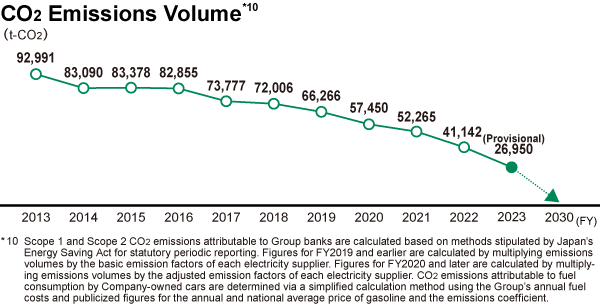

Carbon Neutrality Target (Scope1+2)

- Reduce CO2 emissions*10 attributable to energy used by the Resona Group to net zero by the end of FY2030

- *10Sum of Scope1+2

FY2024 results: 76% reduction from the FY2013 level (a year-on-year decrease of 6,454 t-CO2)

Breakdown of FY2024 Emissions (Provisional)

| Scope1 | 4,321 |

|---|---|

| Scope2 | 17,871 |

Emissions from energy sources |

17,059 |

| Total | 22,192 |

Since approximately 80% of CO2 emissions from Group operations are attributable to energy use, we initiated a phased switchover to energy procured from renewable energy sources in FY2021, starting with energy-intensive facilities.

By the end of FY2024, we had completed this switchover at more than 80% of properties for which the Company procures power supply contracts, with the rate of reduction in CO2 emissions amounting to 76% (provisional; compared with the FY2013 level).

In FY2023, we became a member of the “GX League” promoted by the Ministry of Economy, Trade and Industry and formulated interim emission reduction targets for FY2025.

Going forward, we will continue to promote energy-saving activities across the board to curb the financial impact of the current surge in energy prices and offset costs associated with the switchover to renewable energy to ensure that we can lead the way in the energy transition of our own operations.

Interim targets for FY2025

| Items | Interim targets |

|---|---|

| Scope1+2 | From the FY2013 level: (70)% |

| Scope1 | From the FY2013 level: (40)% |

| Scope2 | From the FY2013 level: (80)% |

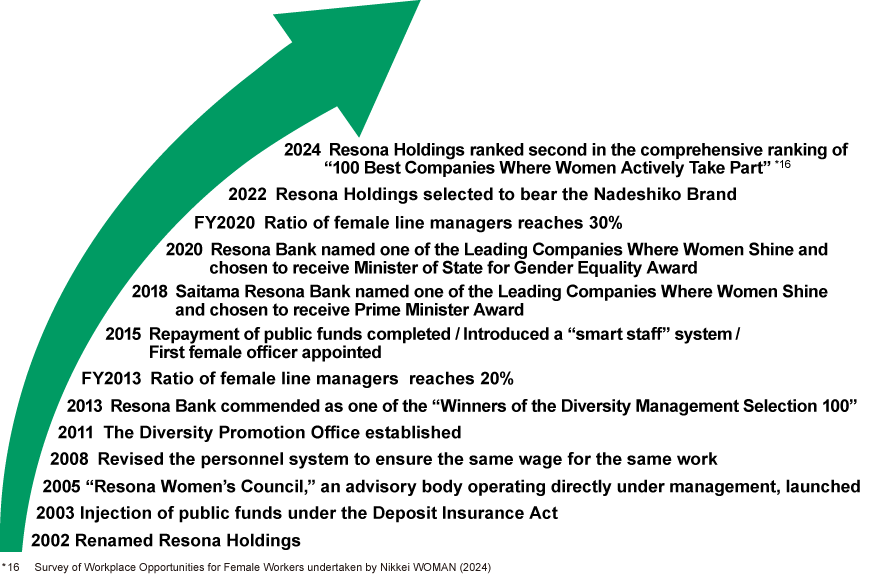

Targets for the Empowerment and Promotion of Women

-

Achieve the below presented ratios for the representation of women in various positions, an increase of 10% or more from the levels at the beginning of FY2021

(by the end of FY2030)

〈Ratio of female directors and executive officers at Resona Holdings: 30% or more〉

〈Ratio of female senior managers at five Group companies*11: 20% or more*12〉

〈Ratio of female line managers at five Group companies*11: 40% or more*12〉

| 2021*13 | 2025*13 | FY2030 targets | |

|---|---|---|---|

| Ratio of female directors and executive officers (Resona Holdings) |

19.2% |

11.7% |

30% or more |

| Ratio of female senior manager (5 Group companies) |

10.5% |

16.5% |

20% or more |

| Ratio of female line managers (5 Group companies) |

29.7% |

34.4% |

40% or more |

- *11Sum of Resona Holdings, Resona Bank, Saitama Resona Bank, Kansai Mirai Financial Group, Kansai Mirai Bank and Minato Bank. Figures for FY2023 and earlier include Kansai Mirai Financial Group.

- *12As of April 1, 2025

- *13The ratio of female directors and executive officers is as of June 30 in 2021 and April 1 in 2025; the ratios of female senior managers and line managers are as of April 1 in 2021 and March 31 in 2025.

| 2002 | Renamed Resona Holdings |

|---|---|

| 2003 | Injection of public funds under the Deposit Insurance Act |

| 2005 | “Resona Women’s Council,” an advisory body operating directly under management, launched |

| 2008 | Revised the personnel system to ensure the same wage for the same work |

| 2011 | The Diversity Promotion Office established |

| 2013 | Resona Bank commended as one of the “Winners of the Diversity Management Selection 100” |

| FY2013 | Ratio of female line managers reaches 20%*14 |

| 2015 | Repayment of public funds completed; Introduced a “smart staff” system; First female officer appointed |

| 2018 | Saitama Resona Bank named one of the Leading Companies Where Women Shine and chosen to receive Prime Minister Award |

| 2020 | Resona Bank named one of the Leading Companies Where Women Shine and chosen to receive Minister of State for Gender Equality Award |

| 2021 | Ratio of female line managers reaches 30% |

| 2022 | Resona Holdings selected to bear the Nadeshiko Brand |

- *14Sum of Resona Bank and Saitama Resona Bank

External Recognitions

Executive Award under the 2024 J-Win Diversity Award Program (Resona Holdings)

Received “Kirari Grand Prize” under the seventh “Osaka Prefecture Vibrant Workplaces Promoting Gender Equality” program (Resona Bank)

Certified under the 2025 Certified Health and Productivity Management Organization Recognition Program (Resona Holdings)

“Gold” rating under the Pride Index for the eighth consecutive year (Resona Holdings)

“Platina Kurumin” certification (Four Group banks)

“Eruboshi” certification (Four Group banks)